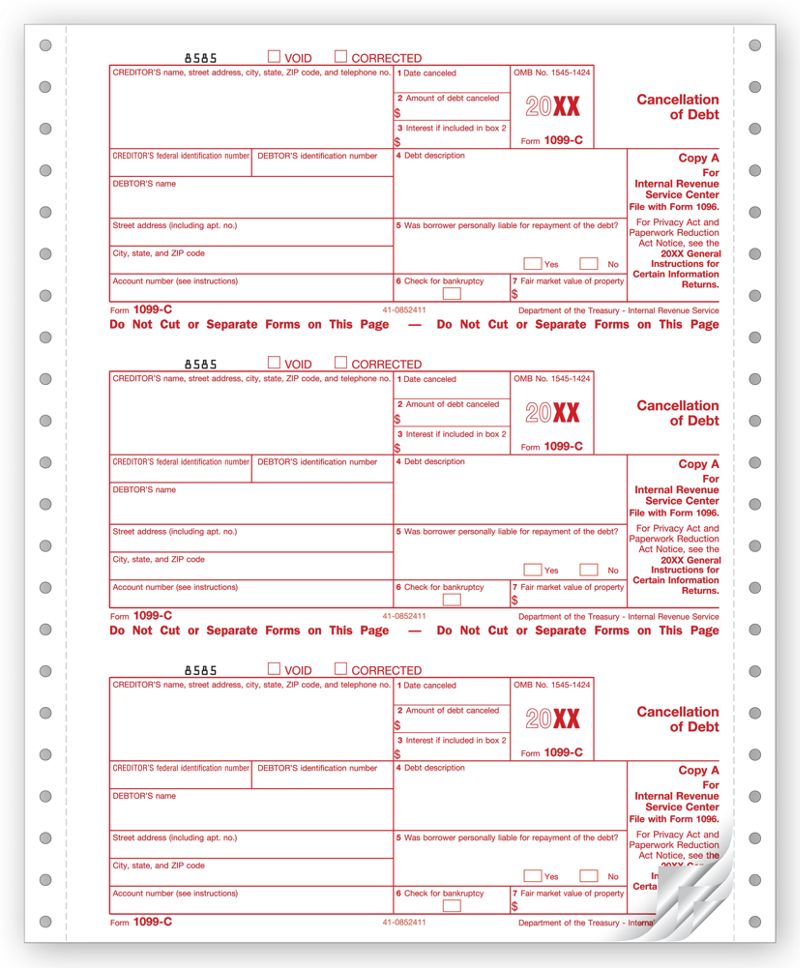

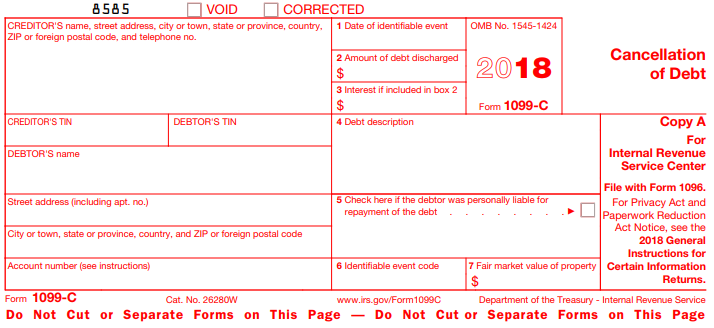

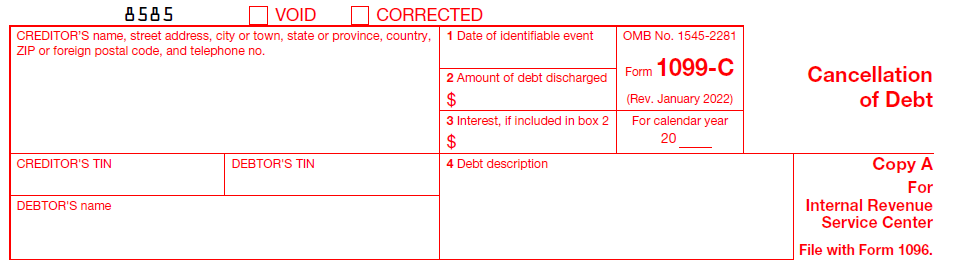

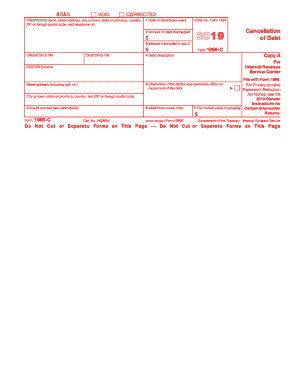

State and Local Taxes;The IRS 1099C form called "Cancellation of Debt," is used when a lender cancels or forgives a debt owed Because the person who owed the money no longer has to pay this debt, the IRS considers amounts over $600 on this form as taxable income The IRS requires the decedent's estate to pay taxes on the amount of the canceled debt reported with 1099C Lenders must file this form with · About Form 1099C, Cancellation of Debt More In Forms and Instructions File Form 1099C for each debtor for whom you canceled $600 or more of a debt owed to you if You are an applicable financial entity An identifiable event has occurred

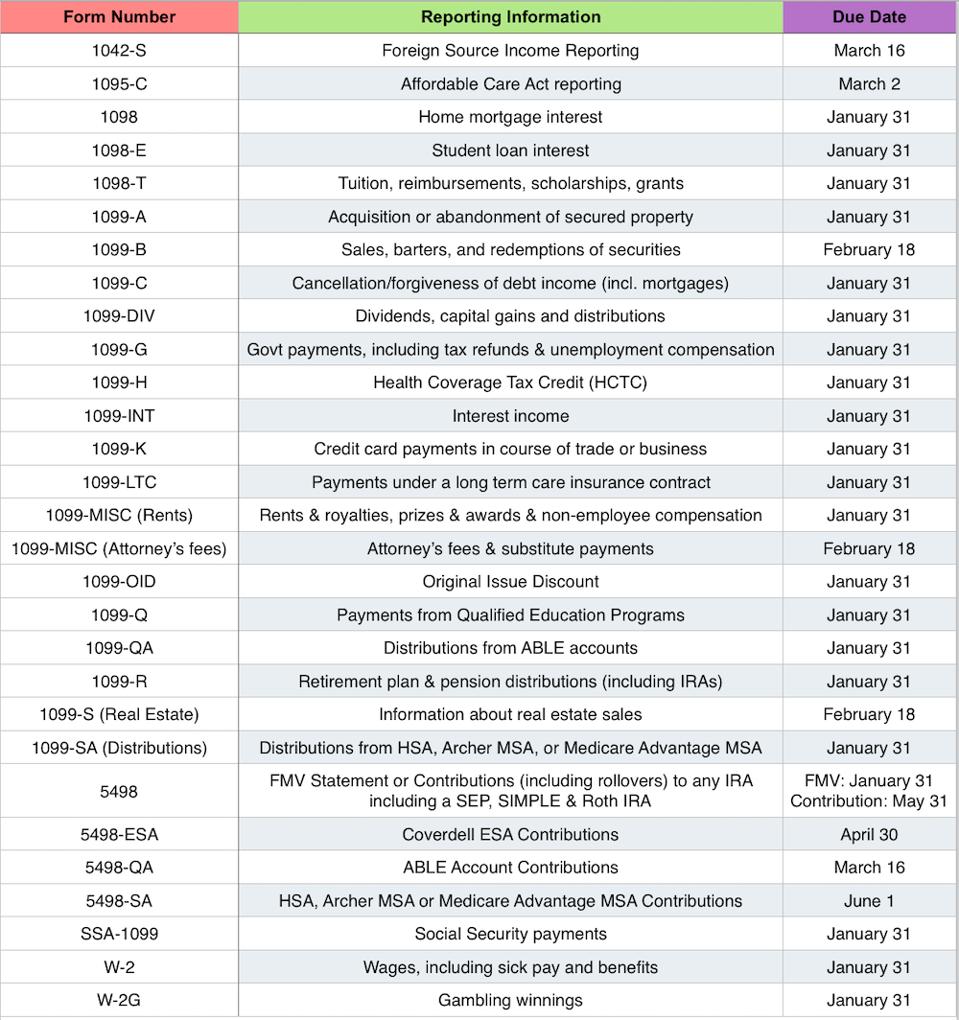

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

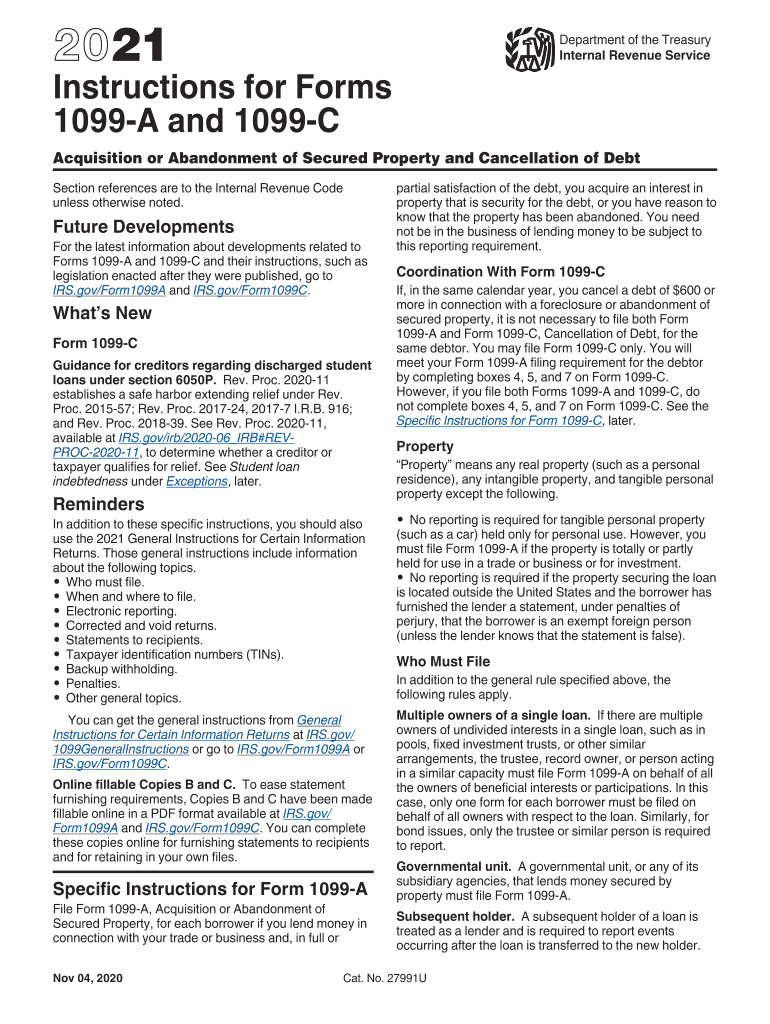

1099 c instructions 2020

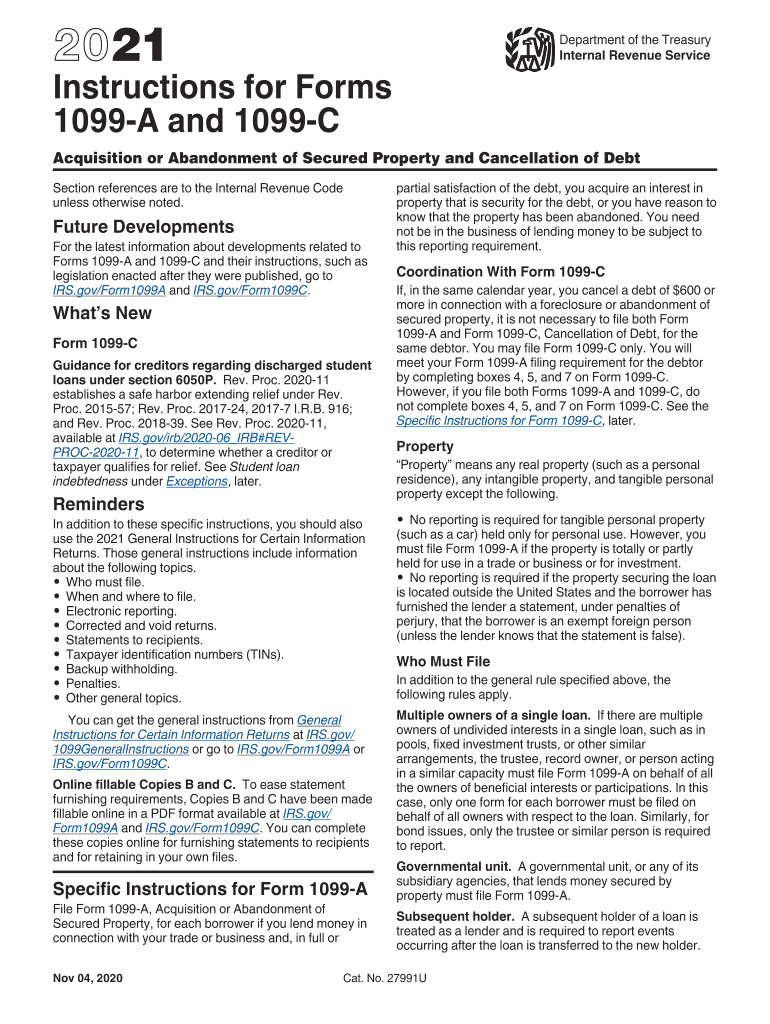

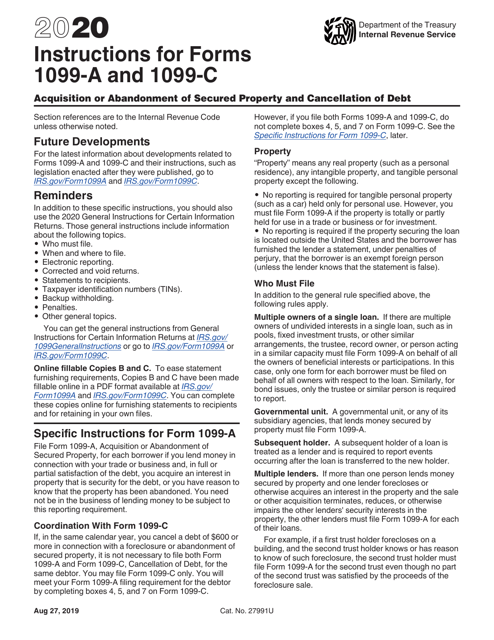

1099 c instructions 2020-To complete Form 1099C, use • The General Instructions for Certain Information Returns, and • The Instructions for Forms 1099A and 1099C To order these instructions and additional forms, go to wwwirsgov/Form1099C Caution Because paper forms are scanned during processing, you cannot file Forms 1096, 1097, 1098, · I'm doing my 19 taxes not I was able to select the Jump to link to download the 1099C I answered the the following questions On the Tell us about your canceled debt screen, select Yes;

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

Home/IRS/IRS Forms/1099 Forms/ 1099 C Form 21 1099 Forms 1099 C Form 21 Josie Carson Last Updated November 26,Efile Form 1099C Online to report the Cancellation of debt Efile as low as $050/Form IRS Approved We mail the 1099C copies to your debtor2611 · Form 1099C—Cancellation of Debt is the tax form that reports canceled debt which is taxable in most cases This includes the debt that has been canceled, Menu;

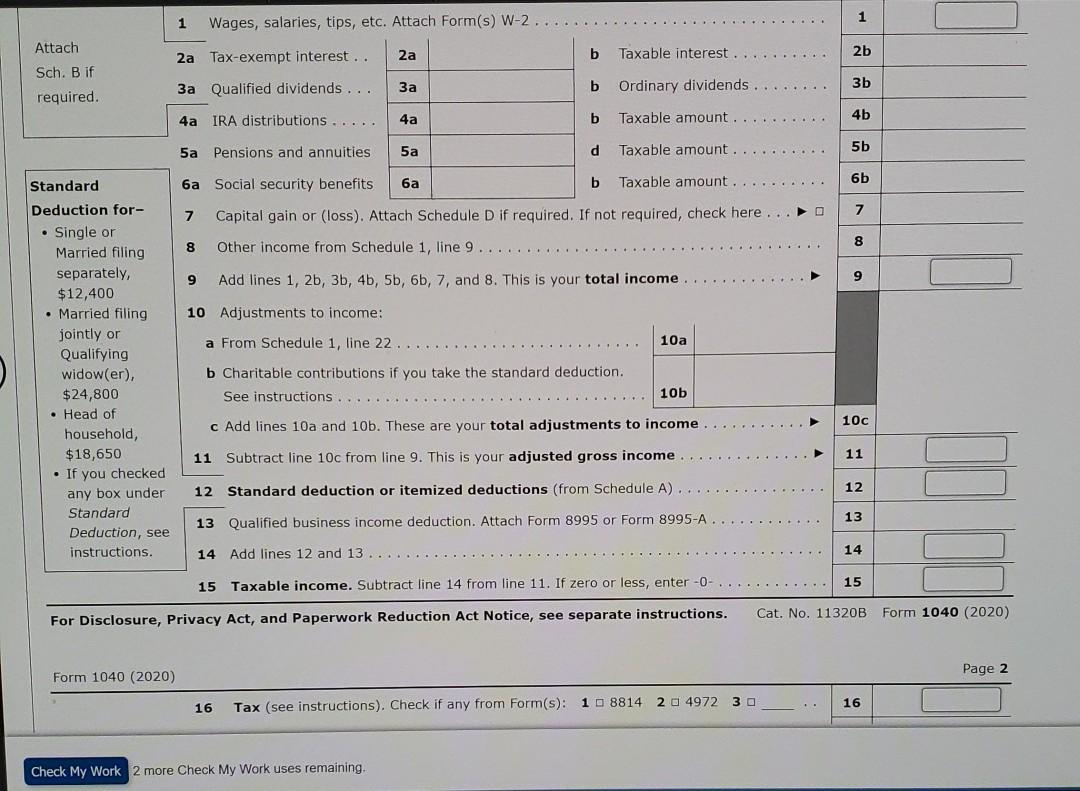

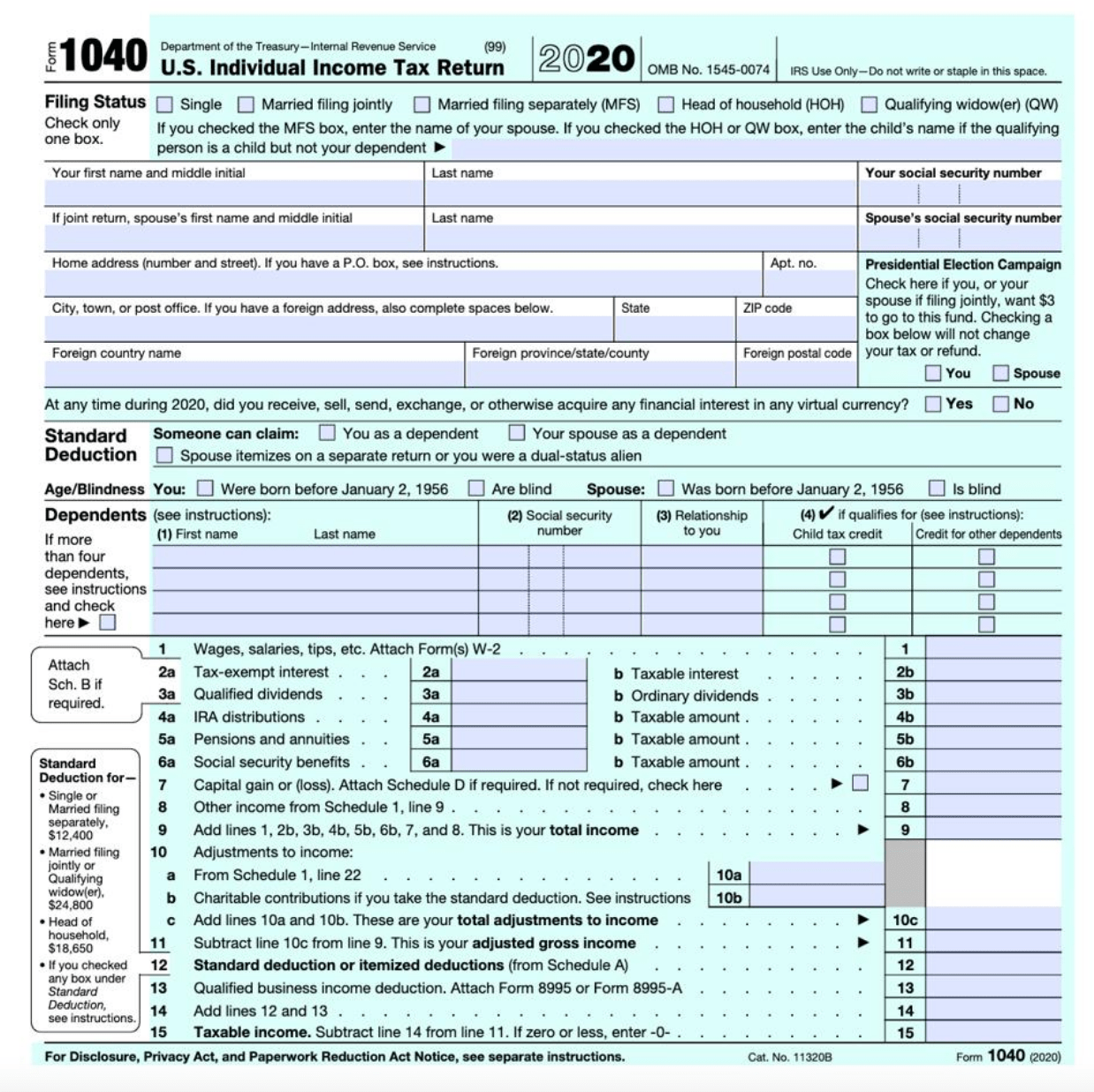

Changes R INSTRUCTIONS Recovery rebate credit This credit is reduced by any economic impact payments you received Charitable contributions You can claim a deduction for charitable contributions if you don't itemize your deductions on Schedule A (Form 1040) For details on these and other changes, see What s New in these instructions See IRSgov and IRSgov/Forms, and0806 · Hit enter to search Help Online Help Keyboard Shortcuts Feed Builder What's newMethod 1 To have the amounts from the IRS 1099C flow to the 1040 line 21 as other income If playback doesn't begin shortly, try restarting your device Videos you watch may be added to the TV's watch history and influence TV recommendations

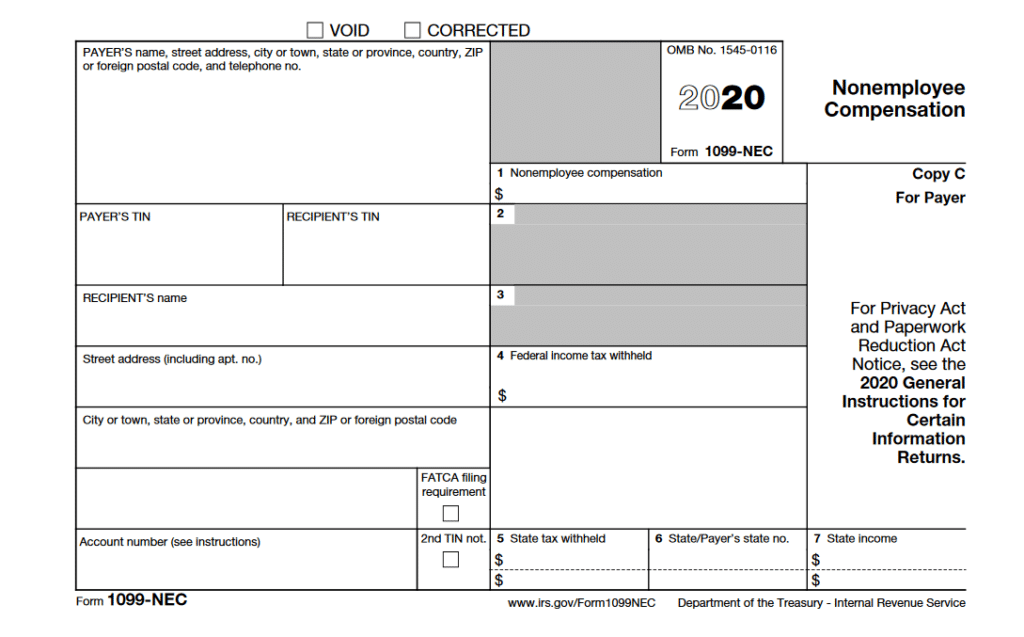

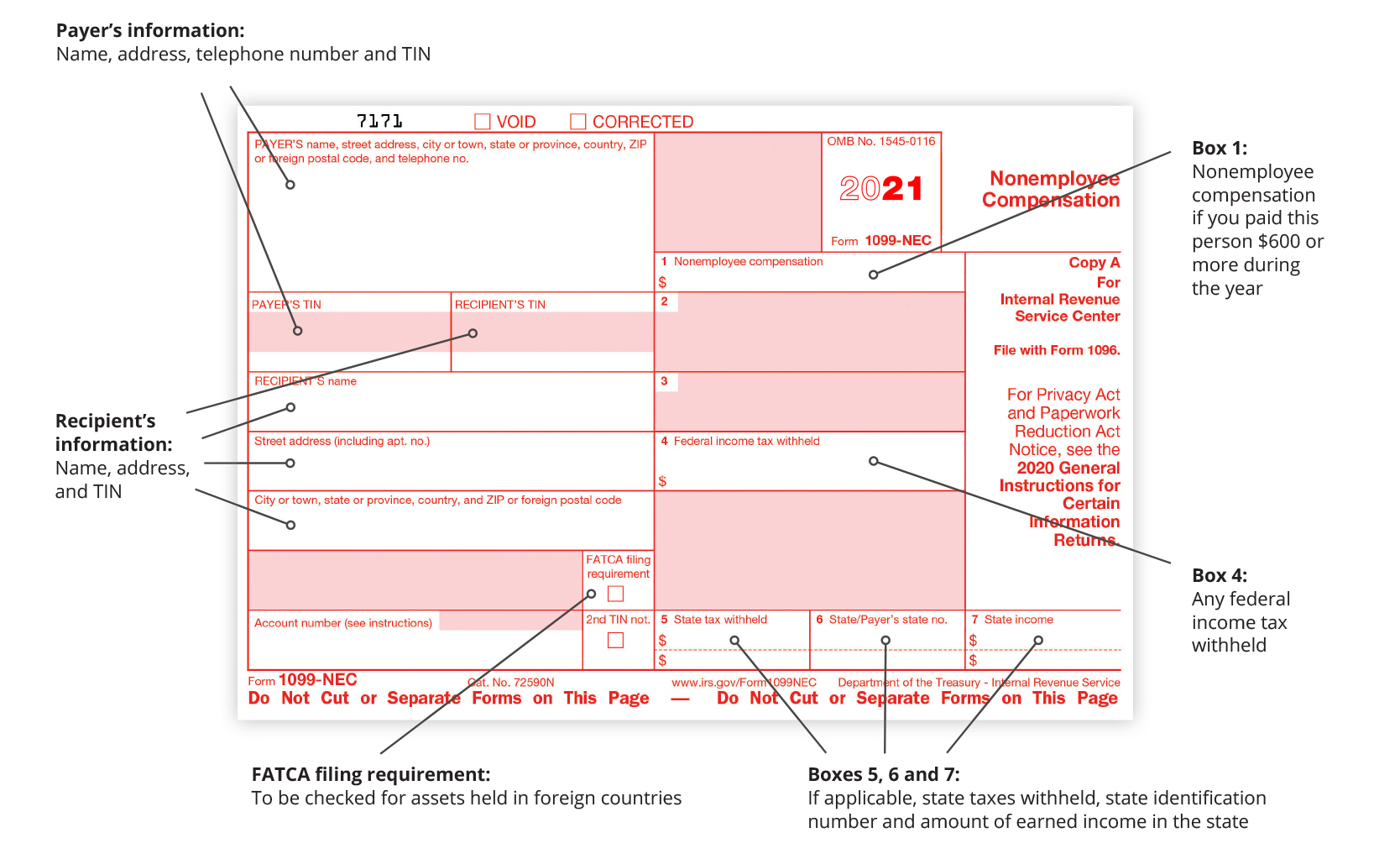

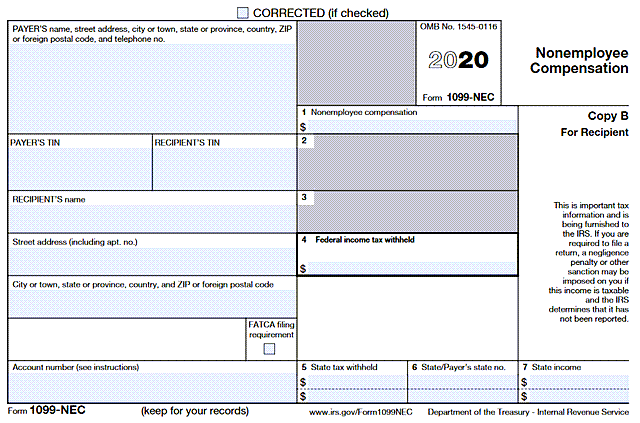

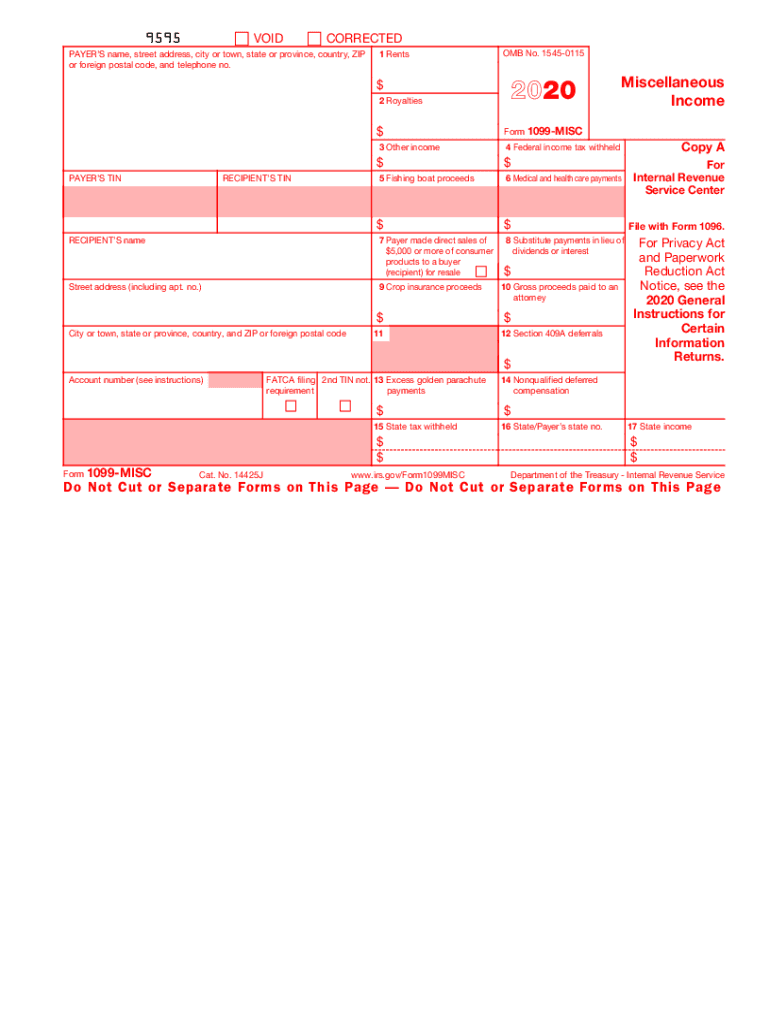

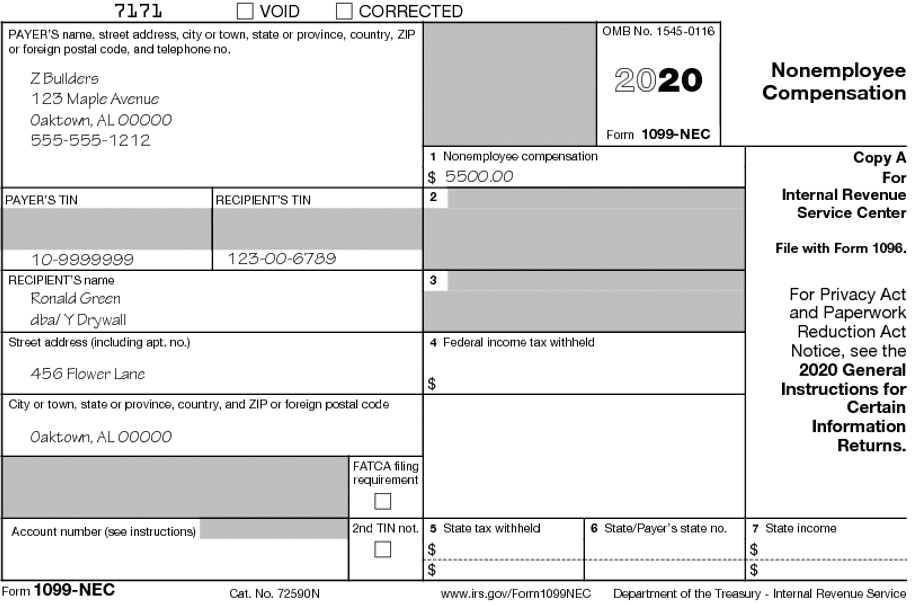

11 · " Accessed Nov , IRS "Instructions for Forms 1099MISC and 1099NEC ()" Accessed Nov , IRS "Reasonable Cause Regulations and Requirements for Missing and Incorrect Name/TINs," Pages 610 Accessed Nov , IRS "General Instructions for Certain Information Returns," Pages 1 and 15 Accessed Nov ,Form 1099C Cancellation of Debt; · But you still MUST report it on your tax return (see instructions below on how to enter your 1099C) We generally recommend using the CD/Download version of TurboTax Deluxe or a higher edition I notice that you are currently using our TurboTax online product If you have not paid anything yet, you can easily cancel and change to the desktop version for your return

Cancellation Of Debt Form 1099 C What Is It Do You Need It

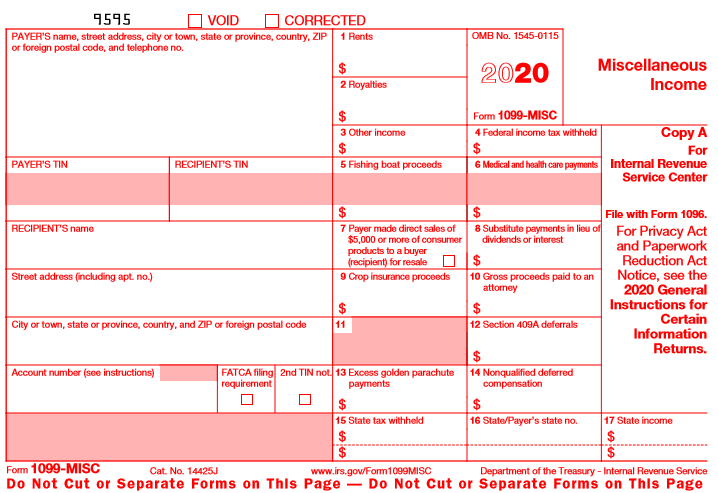

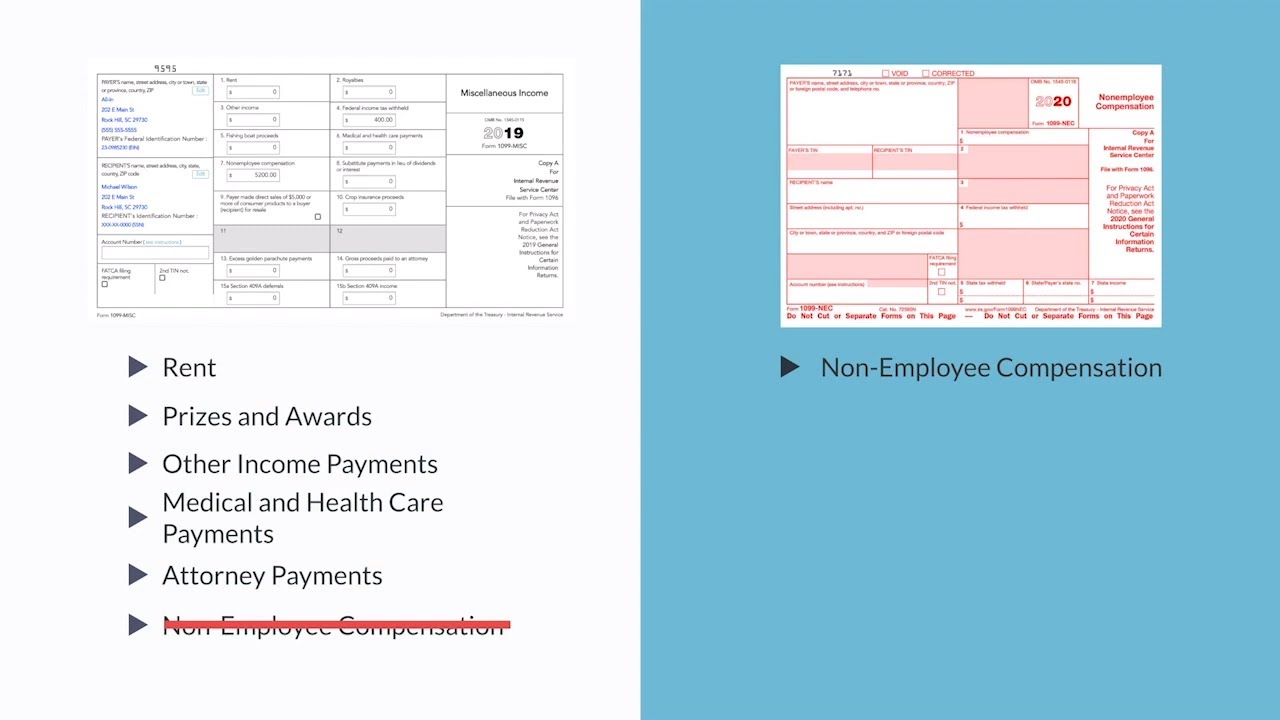

1099 Misc Form Fillable Printable Download Free Instructions

Debt forgiveness, tax calculators and figuring out your tax bill;0112 · If you have a 1099C form but did not include the forgiven debt as taxable income, you can file an amendment to your tax return Use Form 1040X ,Enter the information from your paper form in the corresponding spaces on the 1099 form screen See the "Help" box on the upperright of the screen for more information about each entry 7 Click the green "Save" button at the bottom of the 1099 screen when it's completed

1099 C Software To Create Print E File Irs Form 1099 C

Form 1099 Misc Instructions

However, it did not take me to where I need to enter the information from the 1099CForm 1099C According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt Common examples of when you might receive a Form 1099C include repossession, foreclosure, return of property to a lender, abandonment of property, or1099 form How to create an eSignature for the form 9 examples Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures How to make an esignature for the 19 Instructions For Forms 1099 A And 1099 C Irsgov in the online mode How to create an esignature for your 19 Instructions For

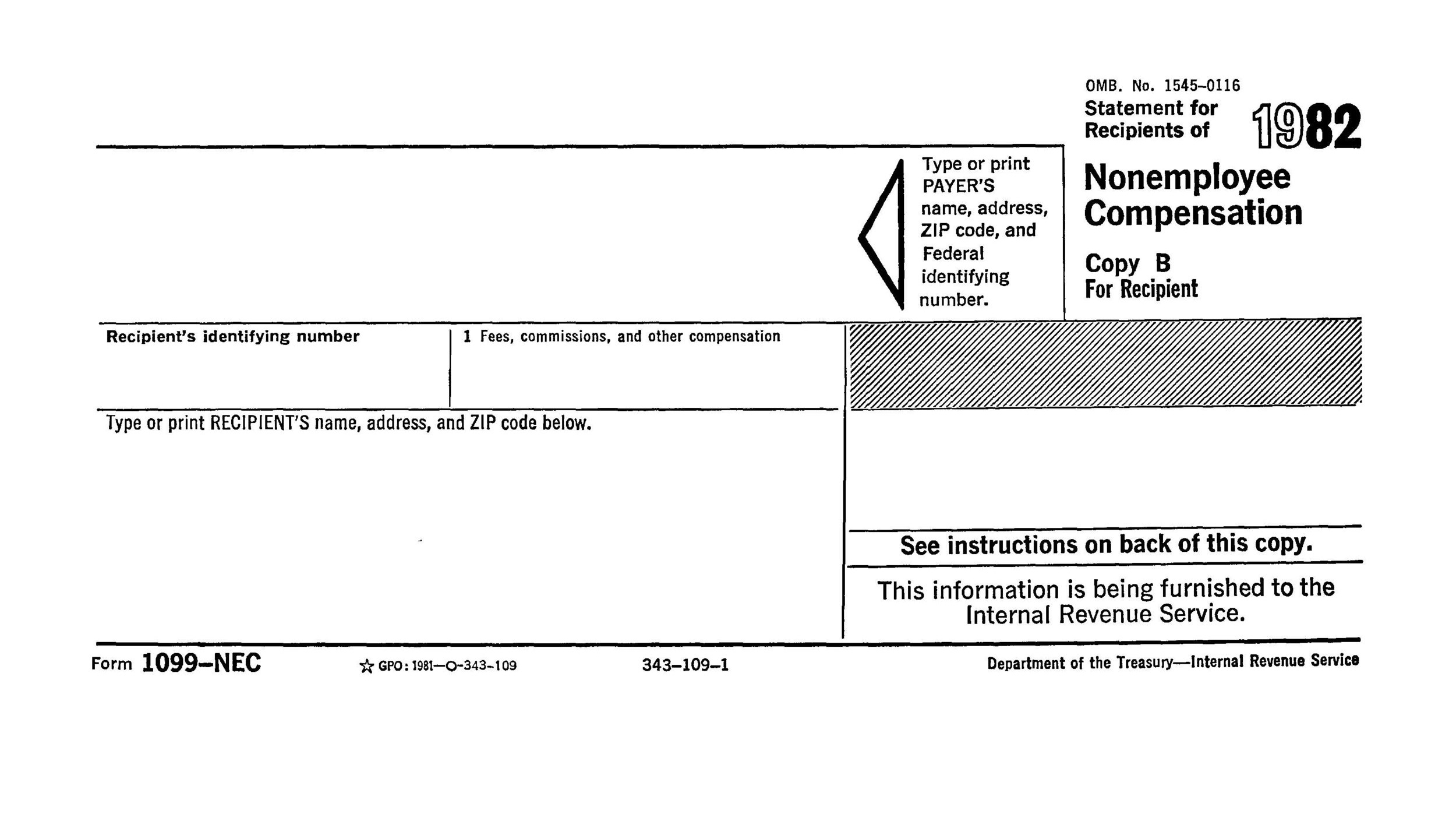

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

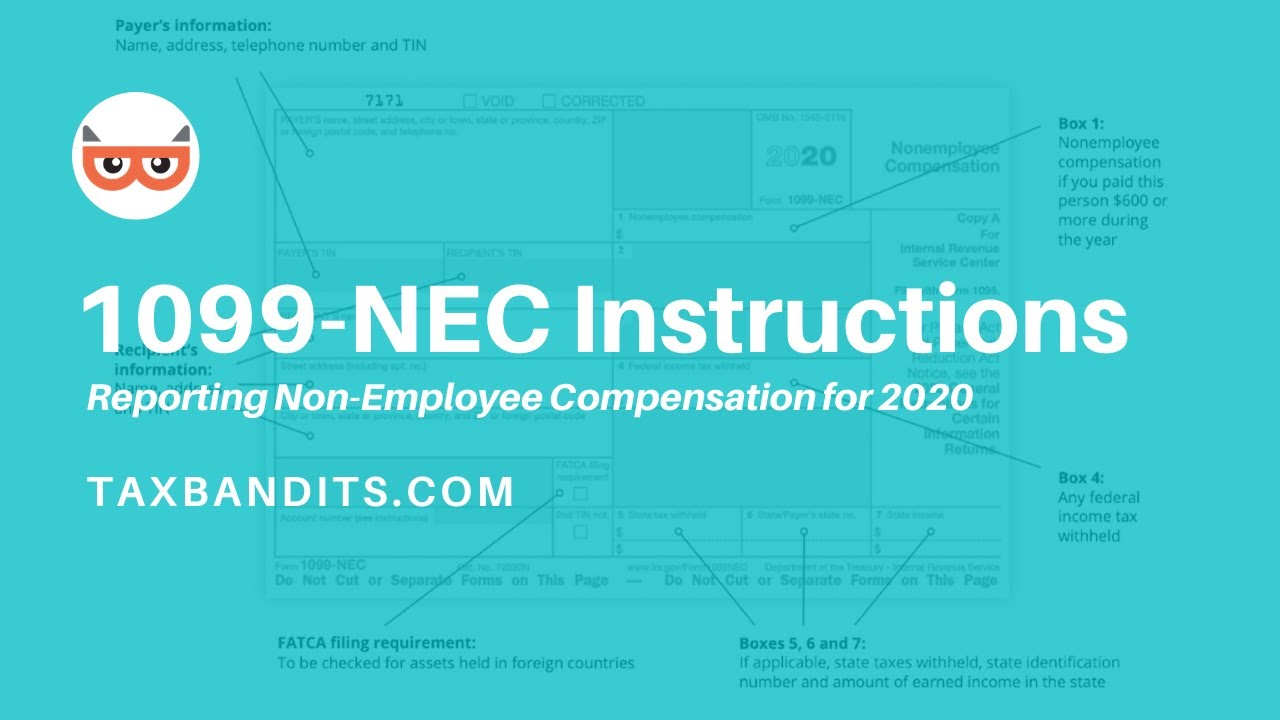

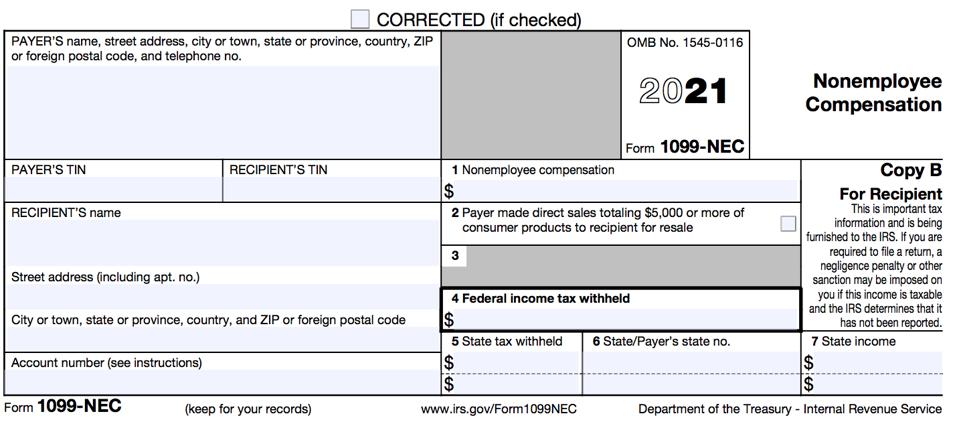

Form 1099 Nec Instructions And Tax Reporting Guide

What to know about Form 1099C and cancellation of debt If you've received at least $600 in forgiveness for your student loans, you'll be sent a Form 1099C by your creditor TheSelect the type of canceled debt (main home or other) and then select Continue; · The IRS requires that businesses send Forms 1099C to consumers when the lender cancels or forgives more than $600 in debt Businesses aren't required to tell you the tax implications of canceling or forgiving loans, but they're obligated to provide a

What Is The Account Number On A 1099 Misc Form Workful

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

0402 · Forms & Instructions; · Instructions for Creditor To complete Form 1099C, use • The General Instructions for Certain Information Returns, and • The Instructions for Forms 1099A and 1099C To order these instructions and additional forms, go to wwwirsgov/Form1099C Caution Because paper forms are scanned duringInstructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) 21 Form 1099B Proceeds

Form 1099 Nec Nonemployee Compensation 1099nec

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Schedule 1299C Instructions (R12/) Page 1 of 5 Illinois Department of Revenue Schedule 1299C Instructions What's new for ?0121 · Updated on January , 21 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the taxWhat if you can't pay your tax bill?

What Is Form 1099 Nec For Nonemployee Compensation

/ScreenShot2020-02-03at10.56.32AM-37cc88c042894d73946efcc05529c80f.png)

Cancellation Of Debt On Investment Property Property Walls

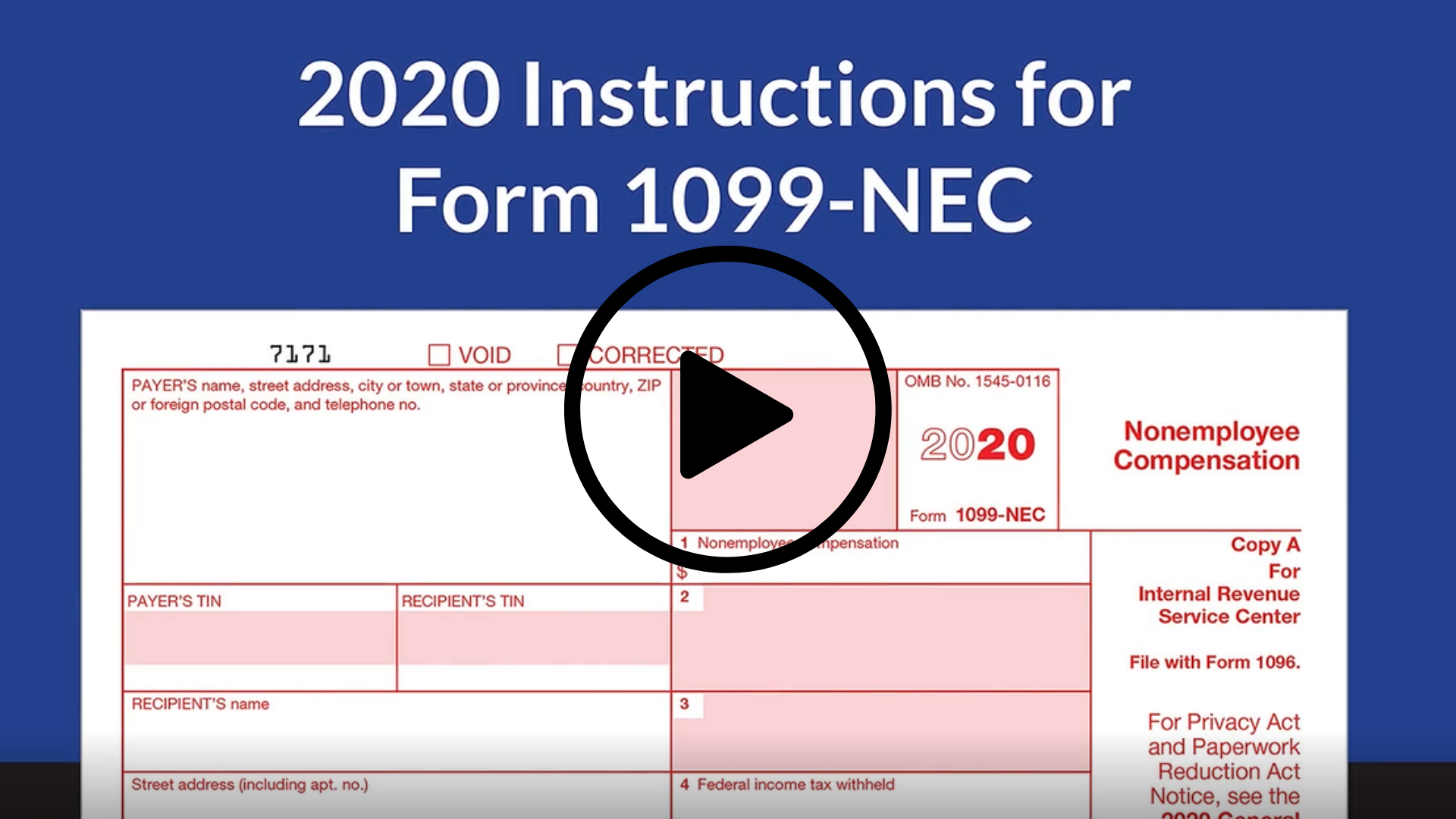

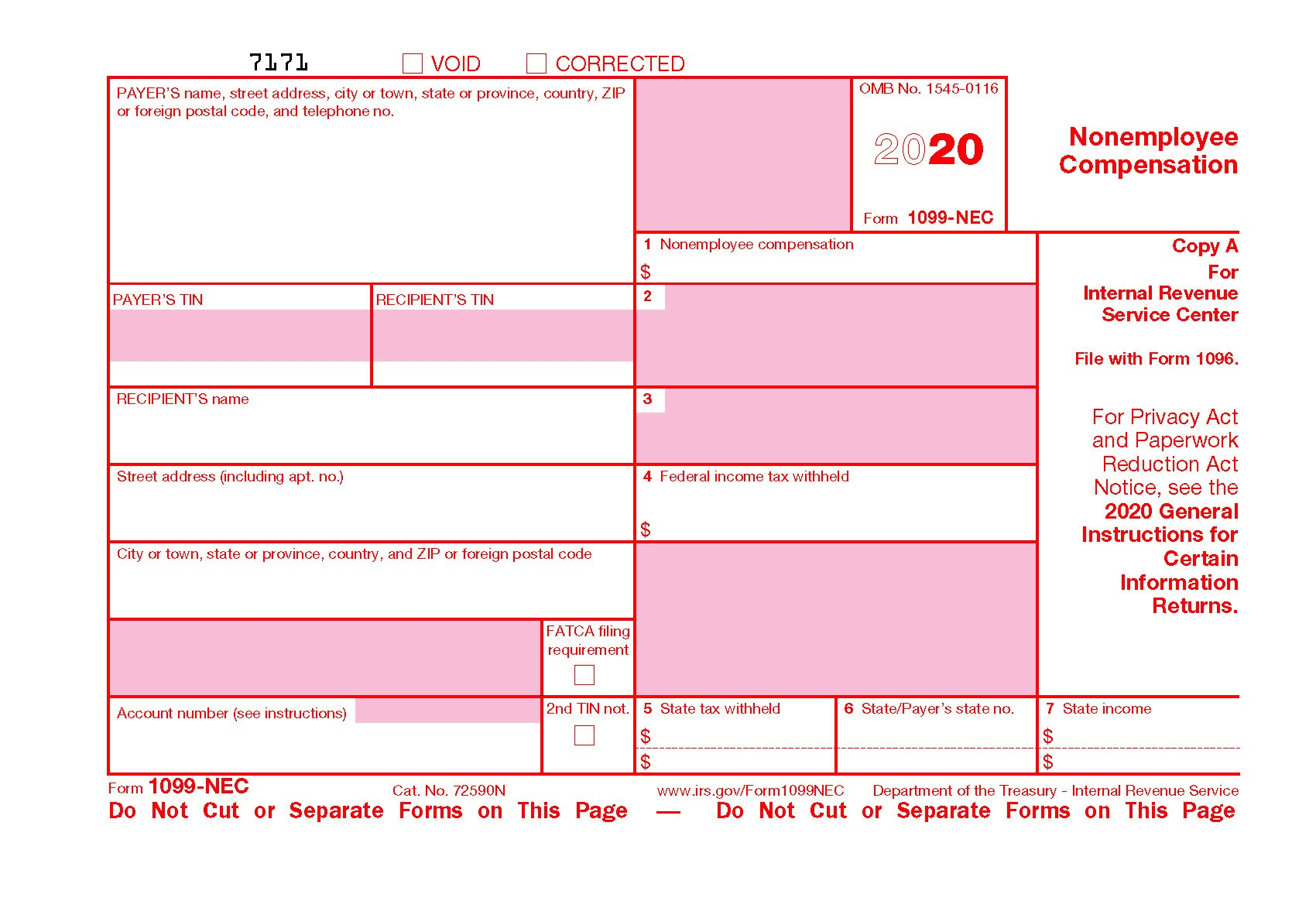

Instructions for Forms 1099MISC and 1099NEC Miscellaneous Income and Nonemployee Compensation Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Forms 1099MISC and 1099NEC and their instructions,1902 · if they are only Guarantors, they should not have received a 1099C Instructions for 1099c are VERY clear on this but some lenders refuse to follow instructions and regulations on this If parents are guarantors they received none of the proceeds of the loan and don't have discharge from debt income because being a Guarantor is not being Debtor contingent liability,0704 · You might get 1099 forms if you have rent, royalty, or contract income, for example Typically, the rule for 1099 forms is that if someone pays you $600 or more within a year, they must report it on a 1099—and you need to report it on your taxes The 1099C form is specifically used to report income related to cancellation of debt

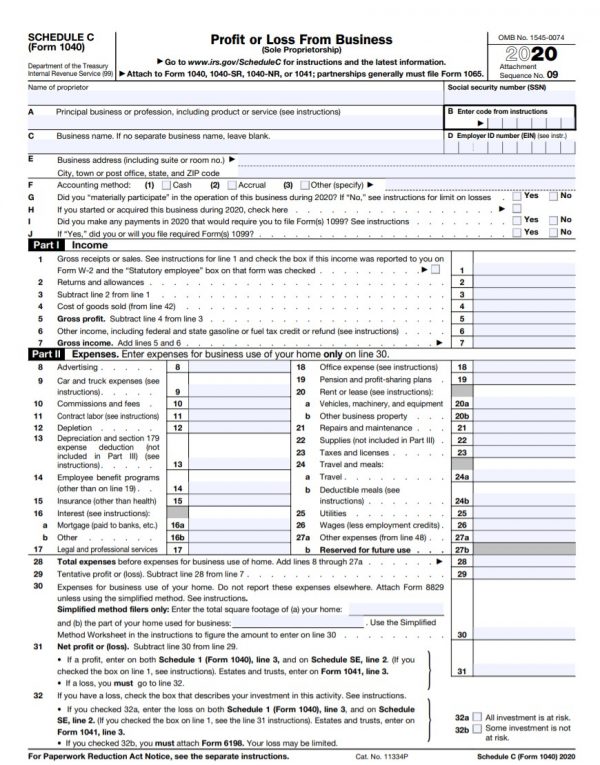

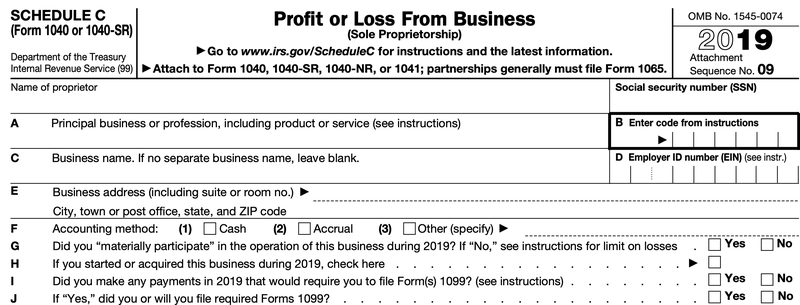

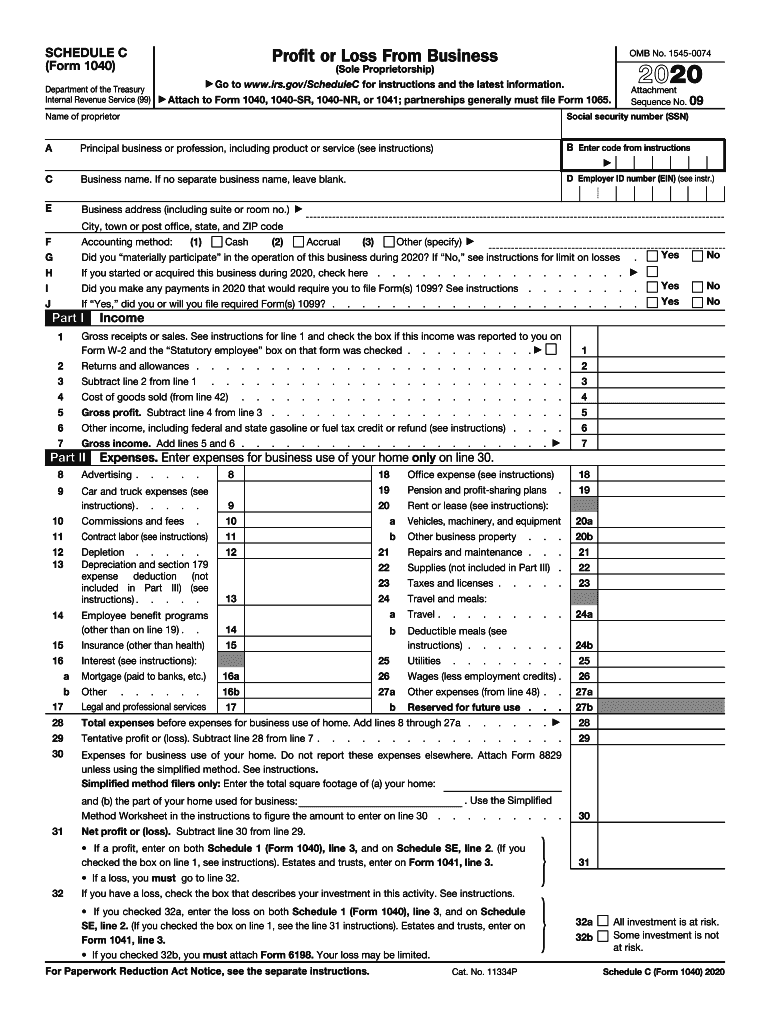

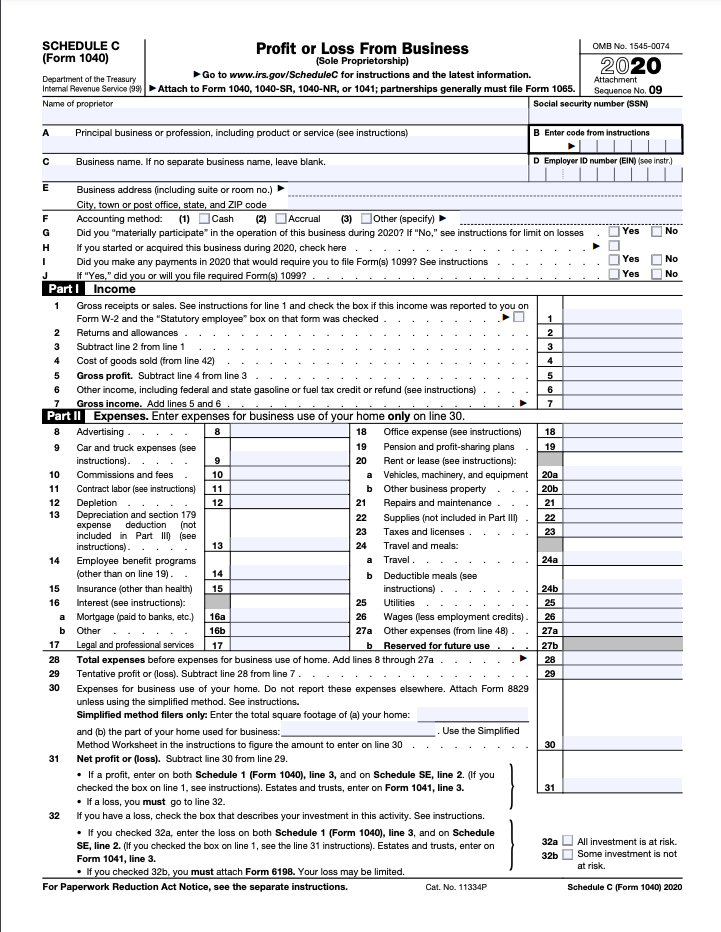

What Is Irs Schedule C Business Profit Loss Nerdwallet

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

Form 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wagesDownload or print the Federal Form 1099C (Cancellation of Debt (Info Copy Only)) for FREE from the Federal Internal Revenue Service1409 · But even if they processed the payment in January of the 1099C should be issued for the tax year and not 21, even though you would receive it in 21 Form 1099 Correction Process Call the IRS and have an IRS representative initiate a Form 1099 complaint The IRS will fill out form 4598, "Form W2, 1098, or 1099 Not Received, Incorrect or Lost" A letter will

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

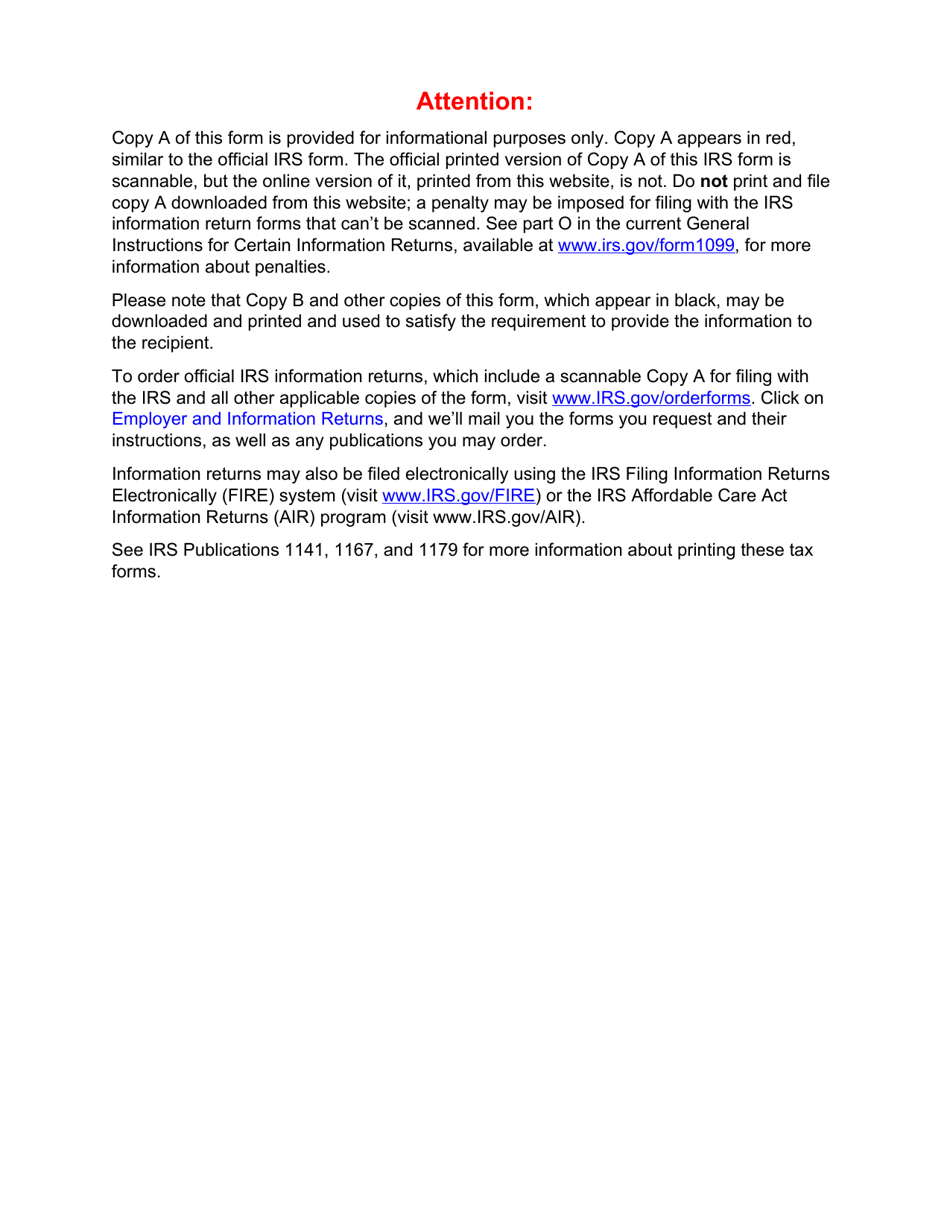

Part F in the General Instructions for Certain Information Returns Forms 1099QA and 5498QA can be filed on paper only, regardless of the number of returns · Ask for a corrected 1099C form New for the tax year Thanks to the federal government's Consolidated Appropriations Act, which was signed into law on Dec 27, , taxpayers who've had mortgage debt forgiven might not have to pay taxes on it when filling out their income taxes this yearNew for tax year 1099NEC, nonemployee compensation Read more An information return is a tax document that banks, financial institutions, and other payers send to the IRS to report payments paid to a nonemployee during a tax year Individuals and businesses receive 1099s Common income types reported on a 1099 include Nonemployee compensation;

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

• •Public Act 1017 creates the Apprenticeship Education Expense Credit effective for tax years beginning on or after January 1, · Accessed Jan 17, Internal Revenue Service " Instructions for Forms 1099A & 1099C" Accessed Jan 17, Internal Revenue Service " Form 1099C" Accessed Jan 17, 19 Internal Revenue Service Form 1099C Accessed Feb 3 Internal Revenue Service "How to Prepare Your Tax Return for Mailing" Accessed Jan 17,0804 · 1099C exceptions to taxing student loan forgiveness;

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

Instructions Maria S W 2 Form Form 1040 Tax Table Chegg Com

Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099C Cancellation of Debt (Info Copy Only) 21Revision Date Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of DebtIn this TaxSlayer Pro training video, we will discuss 1099A Acquistion or Abandonment of Secured Property of 1099C Cancellation of Debt We will help you d We will help you d

Forms 1099 C And 1099 A Cute766

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

· Internal Revenue Service " Instructions for Forms 1099A & 1099C" Accessed Jan 17, Internal Revenue Service " Form 1099C" Accessed Jan 17, 19 Internal Revenue Service Form 1099C Accessed Feb 3 Internal Revenue Service "How to Prepare Your Tax Return for Mailing" Accessed Jan 17, Writer Bio John Csiszar earned aForms 1099A and 1099C and their instructions, such as legislation enacted after they were published, go to IRSgov/Form1099A and IRSgov/Form1099C Reminders In addition to these specific instructions, you should also use the General Instructions for Certain Information Returns Those general instructions include information about the following topics2218 · Form 1099C's are commonly omitted from tax returns, resulting in the IRS sending notice CP00 Learn how to handle an underreporter inquiry (CP00) Related Tax Terms Underreported Income Information Statement (Information Return) CP00 Response IRS Balance Due Related IRS Notices IRS Notice CP2501 – Your Tax Return Doesn't Match the Information

What Is An Irs Schedule C Form And What You Need To Know About It

1099 C Cancellation Of Debt H R Block

Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 · For each 1099C that is not for debt forgiven for a primary residence You need to complete an insolvency worksheet to determine your insolvency immediately prior to the forgiveness and immediately after for each case That amount then gets entered on Form 9 for that debt dischargeWhen an individual has a debt that has been discharged, the amount that was discharged is generally treated as taxable income to the individual Under certain circumstances, this amount can be excluded from income, and therefore not taxed In order to report the exclusion, the taxpayer must file Form 9 with their tax return To enter Form 9 in

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Nec Form Copy B C 2 3up Discount Tax Forms

· If your debt is canceled or forgiven, you'll receive Form 1099C (Cancelation of Debt) Note If you received a 1099C for your main home and another 1099C for something else (like a credit card, car loan, or second mortgage) you won't be able to use TurboTax, as we don't support this To enter your 1099C Open or continue your return, if it isn't already openA creditor will be deemed to have met its filing requirements if a lead bank, fund administrator, or other designee of the creditor complies on its behalf The designee may file a single Form 1099C reporting the aggregate canceled debt or may file Form 1099C for that creditor's part of the canceled debt Use any reasonable method to determine the amount of each creditor's partInst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Form 1099A Acquisition or Abandonment of Secured Property (Info Copy Only) 21 Inst 1099 General Instructions

Form 1099 Nec Instructions And Tax Reporting Guide

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) · The creditor must file a 1099C the year following the calendar year when a qualifying event occurs That just means the creditor must file the next year if they discharge or forgive a debt If the creditor files a 1099C with the IRS, then typically it must provide you with a copy by January 31 so you have it for tax filing purposes that year This is similar toBeginning with tax year , use Form 1099NEC to report nonemployee compensation See part C in the General Instructions for Certain Information Returns, and Form 09, for extensions of time to file See part M in the General Instructions for Certain Information Returns for extensions of time to furnish recipient statements

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

E File Form 1099 With Your 21 Online Tax Return

Form 1099C and How to Avoid Taxes on Cancelled Debt Income February 4, Did you know that the IRS considers any forgiven debt as a source of income and that taxes must be paid on that "revenue" And if you've ever settled a debt for less or had debt forgiven completely, you've likely received a surprise in

1099 Rules For Business Owners In 21 Mark J Kohler

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

fed05 Tax Form Depot

About Form 1099 C Cancellation Of Debt Plianced Inc

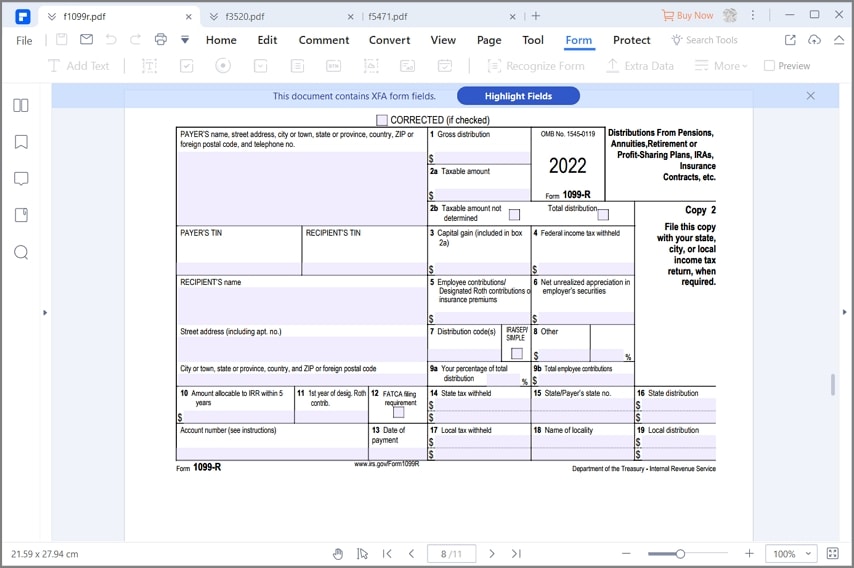

Irs Released 1099 R Instructions And Form Spsgz

Irs Form 1099 Printable Get Blank 1099 Tax Form With Instructions Peatix

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

1099 Misc Public Documents 1099 Pro Wiki

Form 1099 Misc Vs Form 1099 Nec How Are They Different

1099 C Debt Forgiven But Not Forgotten Credit Firm

The 1099 C Tax Consequences Of Debt Settlement South Florida Reporter

Continuous 1099 C 4 Part Carbonless Deluxe Com

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

1099 Nec Form Copy C 2 Discount Tax Forms

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 C Cancellation Of Debt And Form 9

1099 C Tax Form Copy A Laser W 2taxforms Com

1099 C Forms Tax Forms 4 Us

1099 C 18 Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

Form 1099 Nec Nonemployee Compensation 1099nec

Irs Form 1099 C Software 79 Print 2 Efile 1099 C Software

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Irs Form 1099 R How To Fill It Right And Easily

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

What Is Form 1099 Nec

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

What Are Irs 1099 Forms

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

:max_bytes(150000):strip_icc()/Screenshot39-fb0ecf0139834b37943efafda8ef09b4.png)

Irs Form 1099 C What Is It

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Instructions For Forms 1095 C Taxbandits Youtube

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Fillable Online Instructions For Forms 1099 A And 1099 C Instructions For Forms 1099 A And 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Fax Email Print Pdffiller

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Form Irs 1099 C Fill Online Printable Fillable Blank Pdffiller

Office Supplies 1099 C Federal Copy A For 50 Recipients Forms Recordkeeping Money Handling

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

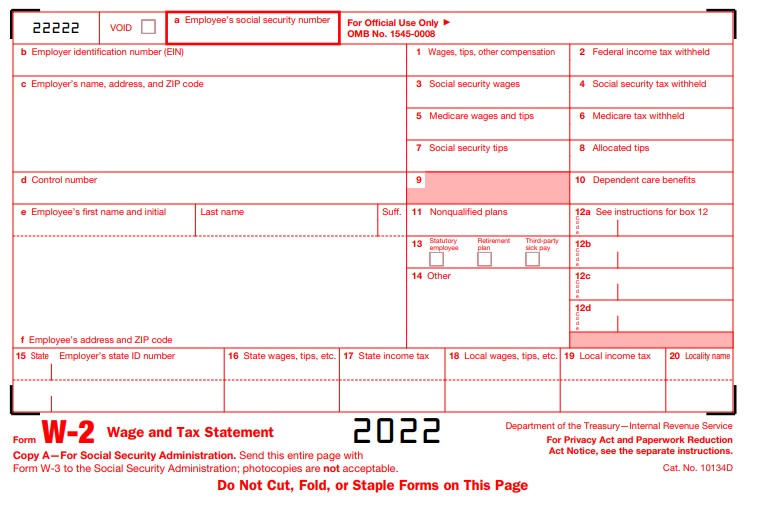

Form W 2 Filing Instructions Form W 2 Boxes

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How A 1099 C Affects Your Taxes Innovative Tax Relief

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Form 1099 Nec For Nonemployee Compensation H R Block

Your Ultimate Guide To 1099s

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

How To File Schedule C Form 1040 Bench Accounting

Form 1099 C Explained

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

What Is The Difference Between Form 1099 Misc Vs Nec Taxbandits Youtube

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About Form 1099

1099 C Cancellation Of Debt Fed Copy A Cut Sheet 500 Forms Pack

Irs Releases Form 1040 For Tax Year Taxgirl

No comments:

Post a Comment