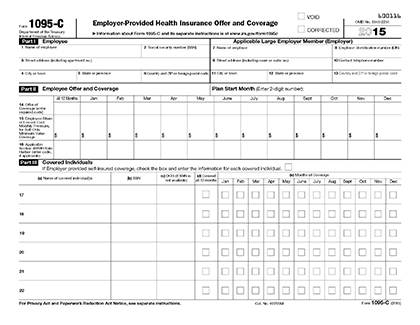

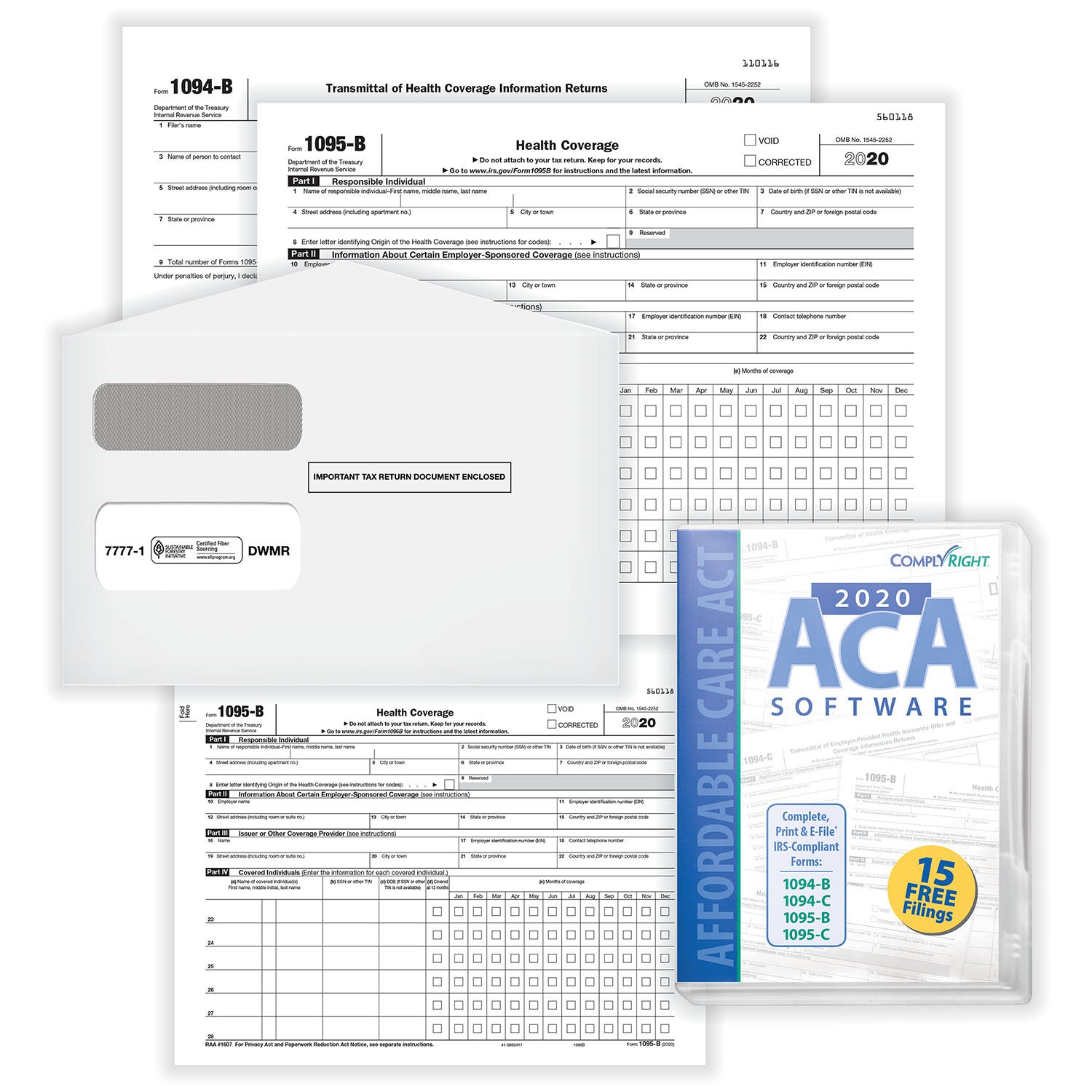

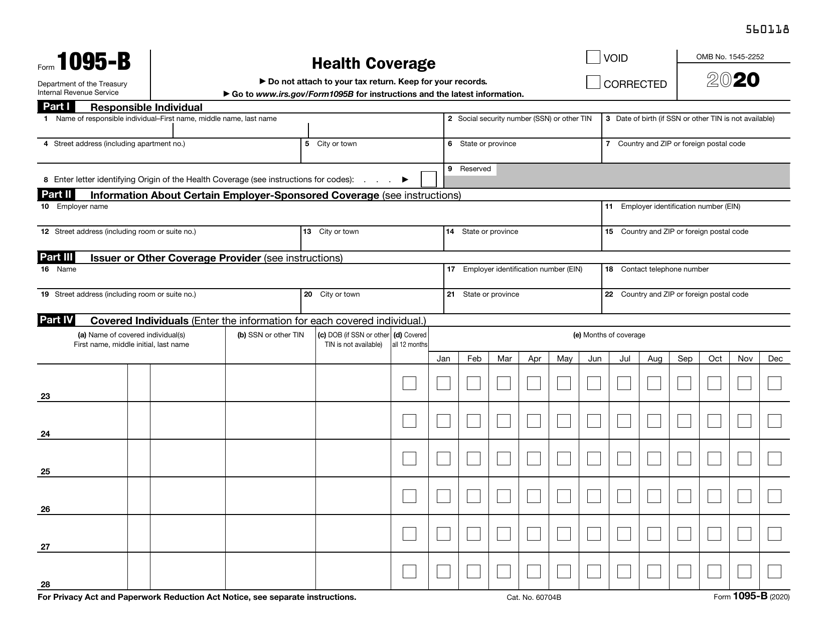

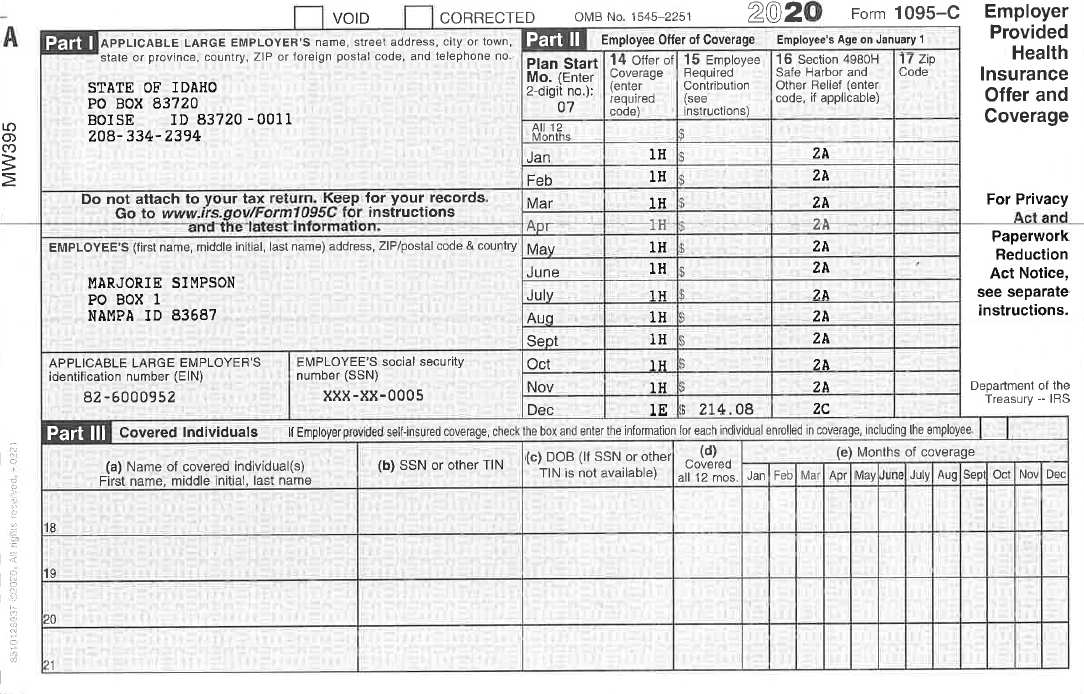

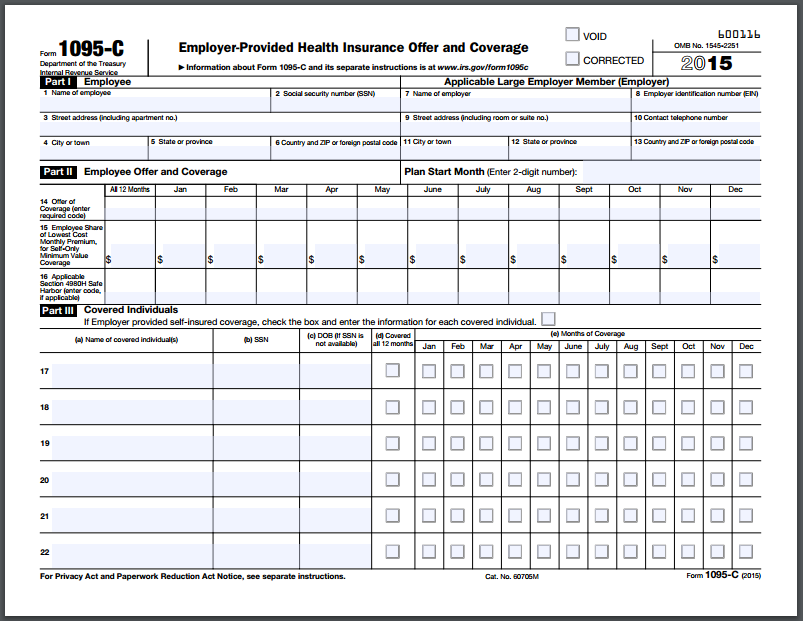

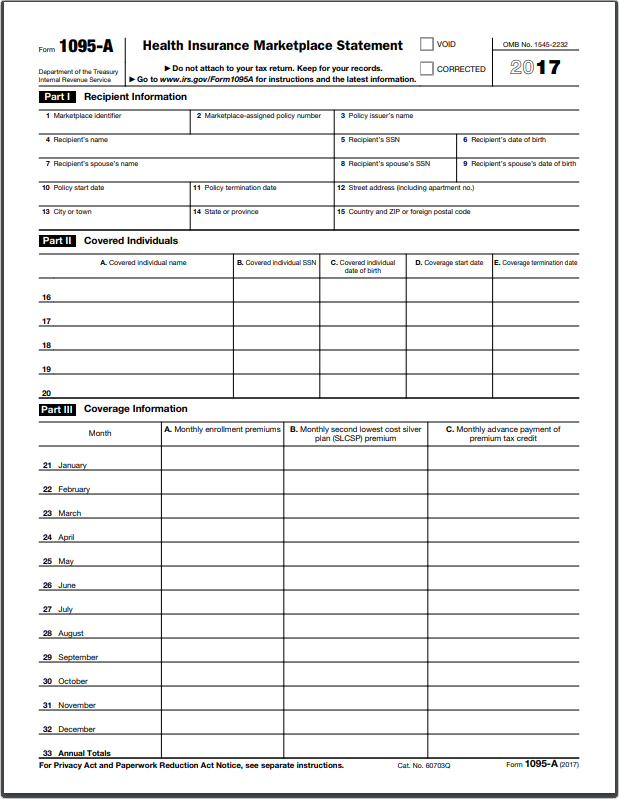

During tax season, Covered California sends two forms to our members the federal IRS Form 1095A Health Insurance Marketplace Statement and the California Form FTB 35 California Health Insurance Marketplace StatementYou will use Form 1095B to verify medical coverage for yourself and your covered tax dependents on your federal income tax filing Receiving Form 1095B does not mean you owe income taxes on the value Employers are required to send Form 1095C for the tax year by March 2, 21The IRS Form 1095C, also known as the EmployerProvided Health Insurance Offer and Coverage statement, contains important information about medical coverage offered to employees and their dependents by Clemson University While this information is no longer required when filing one's taxes, it should be retained with the employee's

Irs 19 Form 1095 C Now Online Stuttgartcitizen Com

Do i need to enter my 1095-c on my taxes

Do i need to enter my 1095-c on my taxes-Nov 06, · Form 1095C is a tax form reporting information about an employee's health coverage offered by an Applicable Large Employer The taxpayer does not fill out the form and does not file it with a tax returnForm 1095C, EmployerProvided Health Insurance Offer and Coverage, reports whether your employer offered you health insurance coverage and information about what coverage was offered to you This form is f or your information only and is not included in your tax return unless you purchased health insurance through the progress in addition to this

The Irs Wants To Know Has Your Company Filed Form 1095 C

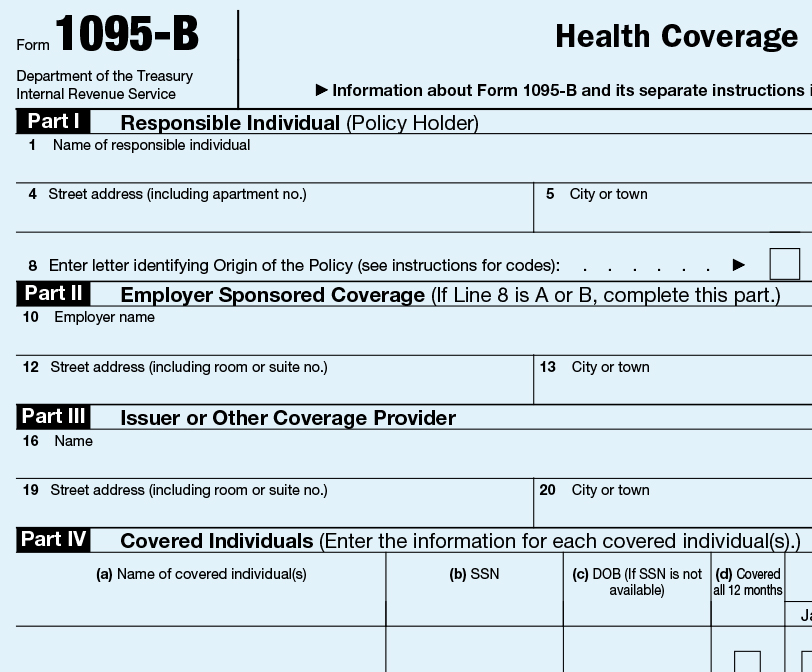

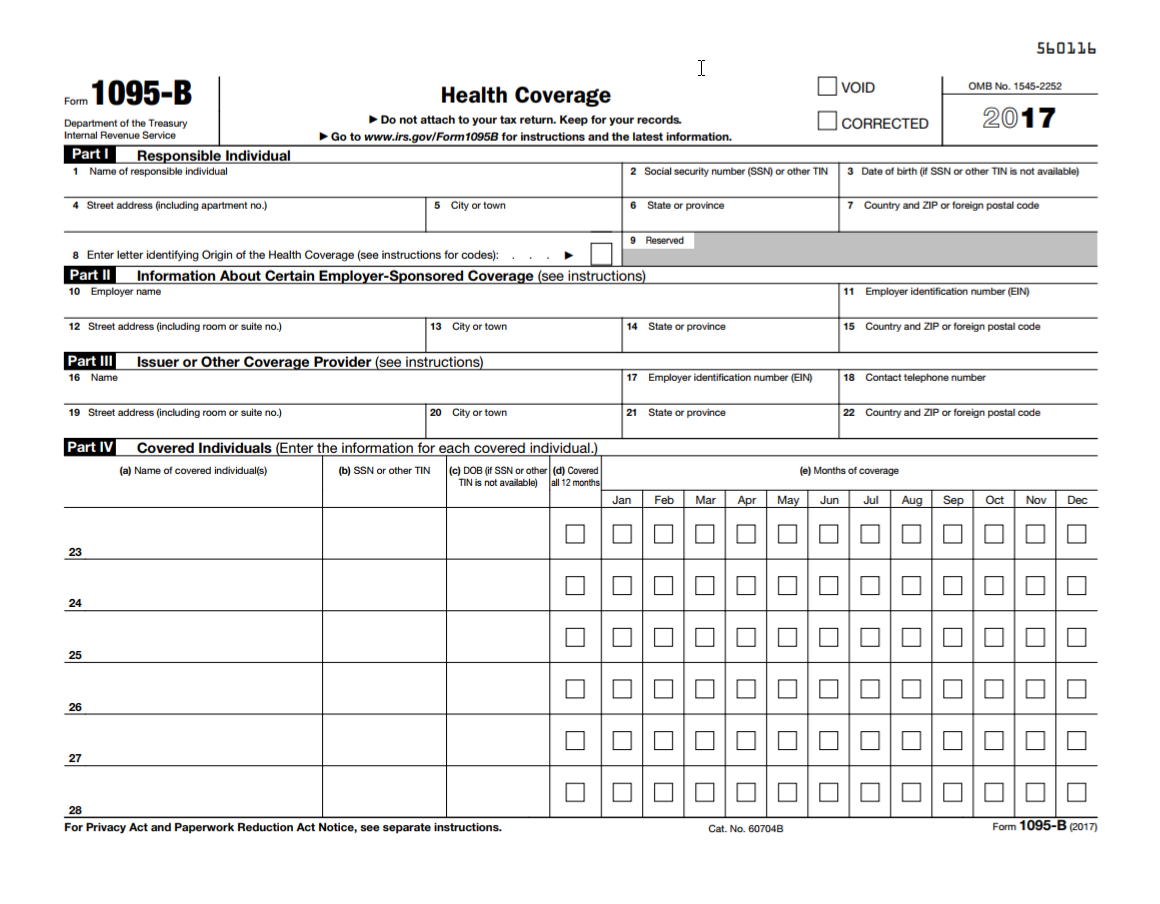

The 1095B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year Beyond that, you shouldn't need to do much of anything with the actual form You retain the document simply as proof of coverage in case some questions arise laterApr 13, 21 · Will use Form 1095C to determine your eligibility for the premium tax credit if you enrolled in coverage through the Marketplace If you or any family members enrolled in selfinsured employer coverage, you may receive Form 1095C showing this coverageForm 1095B Health Coverage is a tax form that is used to verify that you, and any covered dependents, have health insurance that qualifies as minimum essential coverage This form shows the type of health coverage you have, any dependents covered by your insurance policy, and the dates of coverage for the tax year

Mar 23, 21 · The Form 1095B is an Internal Revenue Service (IRS) document that many, but not all, people who have MediCal will receive The Department of Health Care Services (DHCS) only sends Form 1095B to people who had MediCal benefits that met certain requirements, known as "minimum essential coverage (MEC)," at least one month during the tax yearMar 04, 16 · Proving Health Insurance for Your Tax Returns Individuals who have health insurance should receive one of three tax forms for the tax year the Form 1095A, Form 1095C or Form 1095B The forms are sent to individuals who are insured through marketplaces, employers or the governmentHealth insurance providers for example, health insurance companies – may send Form 1095B to individuals they cover, with information about who was covered and when Certain employers will send Form 1095C to certain employees, with information about what coverage the

Mar 02, 21 · About Form 1095C, EmployerProvided Health Insurance Offer and Coverage About Form 09, Application for Extension of Time to File Information Returns About Form 62, Premium Tax CreditJun 06, 19 · If the insurance company sent you a 1095B or C, those forms do not need to be entered into the Health Insurance section of your return Simply save them with your tax documents and click on the months covered in TurboTax If it was a 1095A, from the Marketplace, here are directions for obtaining a copy of your 1095A online, or by phone How to find your 1095A onlineComplete your tax return If you and your dependents had qualifying health coverage for all of Check the "Fullyear coverage" box on your federal income tax form You can find it on Form 1040 (PDF, 147 KB) If you got Form 1095B or 1095C, don't include it with your tax return

Affordable Care Act Aca Forms Mailed News Illinois State

What Is Form 1095 C And Why Did I Receive It In The Mail From The Irs

Nov 03, 17 · Your document may be called Form 1095A, 1095B, or 1095C, depending on what type of health insurance you had last year If you expect a 1095A , you will need the form before you finish your taxes People who receive health insurance subsidies generally get Form 1095AInstructions on the IRS Form 1095C you receive contain more information about the form • If you have questions about the information on your IRS Form 1095C, or about lost or incorrect forms, you should call the contact telephone number provided on your IRS Form 1095C The IRSIRS Individual Learn more about form 1095C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 1094C Transmittal form filed with form 1095C from the insurer to the IRS Employer for selffunded plans IRS Learn more about form 1094C

Irs Extends Deadline For Forms 1095 C And 1095 B

New Tax Document For Employees Duke Today

Select "Tax Forms" from the menu on the left Download all 1095As shown on the screen Get screenbyscreen directions, with pictures (PDF, 306 KB) Note If you can't find your 1095A in your Marketplace account, contact the Marketplace Call CenterThe Affordable Care Act requires that certain employers provide you with an IRS tax form called Form 1095C EmployerProvided Health Insurance Offer and Coverage This form is required to be provided to all fulltime employees (working over 30 hours on average) and any person enrolled in CMU's medical plan during the calendar yearForm 1095B Proof of Health Coverage NOTE Your Form 1095B is proof of healthcare insurance for the IRS and does not require completion or submission to DHCSPlease keep this form for your records To understand more about the Federal and State Individual Mandates, please see the information and links below

1095 C Faqs Office Of The Comptroller

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

Jun 01, 19 · Can I deduct payments from 1095c?1095C Tax Form In addition to the standard W2 form, employees also receive the federal tax form called a 1095C Duke provides this form annually as part of the requirements of the Affordable Care Act What does the dollar amount on Line 15 of my 1095C represent?Feb 06, · IRS Form 1095C for 19 IRS Form 1095C is for employees that worked fulltime or received health coverage through their state employment at any point during tax year 19 We encourage you to consent to receive 1095Cs electronically before Feb 10, , to get fast access to the tax form

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C and isGenerally 1095B forms are filed by insurers for employers who use the SHOP, small selffunded groups, and individuals who get covered outside of the health insurance Marketplace 1095C forms are filed by large employersIf they are selffunded, they just fill out all sections of 1095CWhile you will not need to include your 1095C with your tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return The Affordable Care Act requires certain employers to send Form 1095C to fulltime employees and their dependents

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Form 1095 C Forms Human Resources Vanderbilt University

Form 1095C is a required tax document under the Affordable Care Act (ACA) It contains detailed information about the medical coverage offered to you and your dependents by Miami University You will need the information from Form 1095C as part of your federal tax return The IRS will use this information, in part, to validate your complianceForm 1095C verifies if fulltime employees were made an offer of health coverage by their employer that met federal standards of affordability and minimum value Form 1095C also reports enrollment in an employer's selfinsured health plan (eg Uniform Medical Plan) Will IYou will need this form to complete and report your coverage on your income tax return Please keep IRS Form 1095B for your records The VA will also provide IRS Form 1095B to the Internal Revenue Service for every Veteran who received health care coverage through VA in calendar year , as required by law

Accurate 1095 C Forms Reporting A Primer Integrity Data

The Irs Wants To Know Has Your Company Filed Form 1095 C

Feb 16, 21 · For Tax Year Even though IRS Form 1095B isn't required to file taxes, you may still request an IRS Form 1095B listing the coverage you had during from your pay center Visit the Defense Finance and Accounting Service (DFAS) to request an IRS Form 1095BFeb 08, 19 · IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season (or will be sending you soon) in addition to your W2Feb 09, 16 · This form should be filed with your Massachusetts state tax form MIT students, affiliates, and Whitehead employees will receive their forms 1095B from the MIT Health Plans Office If you are a student or affiliate with a question about this form, you may call or send an email to 1095B@medmitedu

18 1095 Deadline Extended From Jan 31 To March 4 Leavitt Group News Publications

What Is Form 1095 C And Do You Need It To File Your Taxes

Jan 18, 15 · Who Has to File 1095B and 1095C Forms?Contact the health care provider if you have questions about the Form 1095B they sent you You can find the name of the health care provider in Part III of the Form 1095B If you need a replacement IRS Form 1095B, call 1800MEDICAREForm 1095C, employerprovided health insurance offer and coverage, shows the coverage that is offered to you by your employer It is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form provides information of the coverage your employer offered and whether or not you chose to participate

Aca Reporting Faq

Aca 1095 C Basic Concepts

Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax creditForm 1095C is also used in determining the eligibility of employees for the premium tax credit ALE Members that offer employersponsored, selfinsured coverage also use Form 1095C to report information to the IRS and to employees about individuals who have minimum essential coverage under the employer plan*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in 16, and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in your

Affordable Care Act Form 1095 B Form And Software 50 Pk Hrdirect

Irs Form 1095 C Uva Hr

Any health insurance policy you yourself paid premiums for can be a deductible medical expense if you itemize If your employer paid those premiums you cannot deduct themIf you worked at more than one company, you may receive a Form 1095C from each company For example, if you changed jobs in this tax year and were enrolled in coverage with both employers, you should receive a 1095C from each employerA) Form 1095B is an IRS document that shows you had health insurance coverage considered Minimum Essential Coverage during the last tax yearUnder the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Mar 23, 21 · With the passing of the Affordable Care Act, three new tax forms came into the scene Form 1095 A, B, and C These tax forms were used to report your healthcare coverage during a tax year But, in 19, the healthcare penalty went awaySimilar to last year, you will be receiving a 1095C form per the Affordable Care Act This form provides verification that you and your dependents had coverage in You will not be required to file this with your tax returns but you will need to retain the form in your recordsJun 07, 19 · Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes" When you come to the question "Were

What Is Form 1095 C And Do You Need It To File Your Taxes

1095 C Eemployers Solutions Inc

Jan 07, 21 · Frequently asked questions Updated on January 7, 21 Q) What is the Form 1095B?Jan 12, 17 · IRS Form 1095C (for Active Duty Military and Federal Civilian Employees) These forms will be available through the online myPay account access system on 17 January 17, for those who have

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Issues Draft Form 1095 C For Aca Reporting In 21

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Benefits 1095 C

What Is The Irs 1095 C Form Miami University

Irs 19 Form 1095 C Now Online Stuttgartcitizen Com

Irs Form 1095 C Codes Explained Integrity Data

Irs Form 1095 B Download Fillable Pdf Or Fill Online Health Coverage Templateroller

Your 1095 C Tax Form My Com

Hr Updates Theu

1095 C Print Mail s

Annual Health Care Coverage Statements

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

trix Irs Forms 1095 C

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

1095 C Employer Provided Health Insurance Offer Of Coverage

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Wuqq1krp2dq06m

What Are 1095 Tax Forms San Diego Sharp Health News

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 C Mymontebenefits Com

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

Wda1rcn3sd6g2m

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Posts Department Of Human Resources Myumbc

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Tax Forms 1095 A 1095 B 1095 C Business Benefits Group

1095 C Faqs Mass Gov

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Irs Form 1095 C Codes Explained Integrity Data

The Abcs Of Form 1095

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

1095 C Form 21 Finance Zrivo

Form 1095 C Guide For Employees Contact Us

Irs Form 1095 C Fauquier County Va

What Is Form 1095 C Acawise Youtube

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

Irs Report About Minimum Essential Coverage Aflac

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Form 1095 B

What Are Tax Form 1095 A And 1095 B

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Code Series 1 For Form 1095 C Line 14

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

What Is Irs Form 1095 Katz Insurance Group

Forms 1095 B And 1095 C What You Need To Know

Aca Update Form 1095 C Deadline Extended And Other Relief

Free 1095 C Resource Employee Faqs Yarber Creative

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

What Are 1095 Tax Forms For Health Care 1095 A 1095 B 1095 C Youtube

Irs 1095 C Form Pdffiller

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

What Is How To Fill It Out Irs Form 1095 C Tax Preparation Services

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Form 1095 A 1095 B 1095 C And Instructions

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 C Form Official Irs Version Discount Tax Forms

No comments:

Post a Comment